Equipment Financing Options

Get the equipment you need while conserving your working capital on purchases of $500 to $1.5 million!

Innovative Foodservice Group has partnered with Credit Key and FS Foodservice Solutions to provide equipment financing options to our valued customers.

Through equipment financing, you’re able to make set monthly payments while recouping the costs as you operate the equipment, all without stretching your cash flow.

Click below to see the different forms of financing options:

We’ve partnered with FS Foodservice Solutions to provide our customers with flexible, transparent, and industry-focused equipment financing. Specializing in the foodservice industry, their team makes it easier for operators to get the equipment they need without straining cash flow. With decades of combined experience in financing and foodservice, they take a consultative approach, getting to know your business and goals so they can match you with the best offers for your needs. Customers always come first, and whether you’re opening your first location or upgrading your kitchen, FS Foodservice Solutions works alongside you to make it happen.

Why We Partner With FS Foodservice Solutions

Foodservice Specialists: They know our industry inside and out. They understand the unique challenges operators face, from navigating change orders to meeting strict timelines, and they speak the foodservice language. Their expertise means they know how to structure financing and get even the toughest deals done.

Fast Approvals: They offer fast credit approvals, so projects don’t stall.

Straightforward Terms: No hidden fees or confusing fine print. Their quotes are free, no-hassle, and come with a soft credit pull so there’s no impact to your credit to see what you qualify for.

Dedicated Support: You’ll have a dedicated Account Executive, so you always know who your point of contact is.

Programs Designed for Operators

Every business is unique; your financing should be too. FS offers flexible programs built to match your cash flow, busy seasons, and growth plans.

Programs Include:

Finance-to-Own: Affordable fixed monthly payments with ownership at the end.

Deferred Payments: Order now, start full payments later to free up cash during critical times. Great for seasonal lulls!

Early Payoff Discounts: Save money when you pay ahead of schedule.

Loan Products: Traditional loan options with predictable terms and fixed payments.

Revolving Line of Credit: Flexible funding you can draw from as needed, giving you quick access to cash for equipment, repairs, or unexpected expenses. Learn more about this program here.

Estimate Your Payments

Use FS Foodservice Solutions’ financing calculator to see how different order amounts and term lengths can fit your budget, so you can plan with confidence before you even apply.

Please link the calculator to open in a new tab and do not embed it into the site

Let’s Plate Success Together

Partner with FS Foodservice Solutions to get ahead of the day, and your competition, with flexible financing options built for operators.

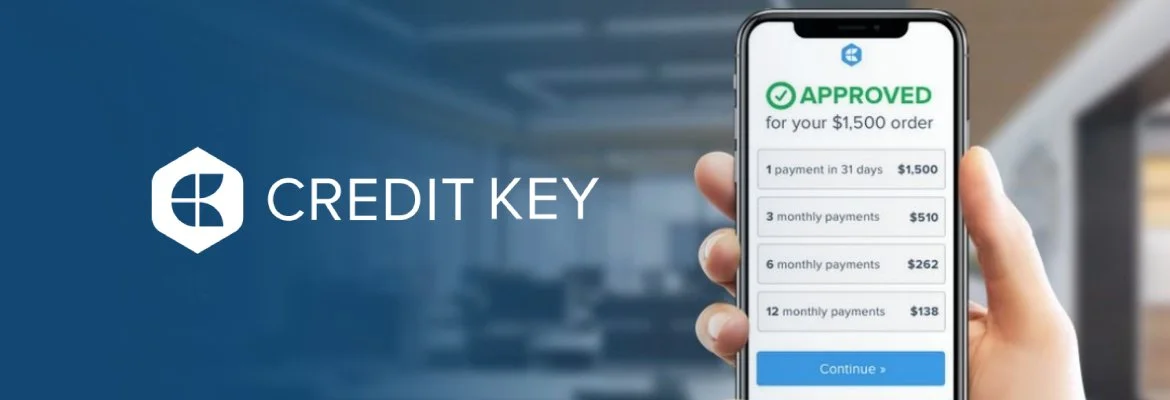

Up to

$50,000

Credit Line

0% for

60

days

Fees starting at

1%

After 30 days

Approvals in

5

Minutes

The funds you need, right where you need them.

Credit Key is not a lease or financed loan, but a line of credit that allows you the flexibility to purchase equipment and supplies as needed. You can qualify for up to a $50,000 line of credit, to use and pay as needed over a 12 month term. You will have the ability to get pre-approved for a certain amount before you order.

To be eligible for Credit Key credit, you will need to:

Be an individual applying under your own name. If your business is a Sole Proprietorship you do not need to have a Federal EIN, but will have to document some type of state registration of the business.

Owner/Signatory of business in application

- Be a U.S. citizen or resident, of minimum signing age in your state of residence

- Have a FICO®/credit score of 600 or above

- Have a total annual business income of $40,000 or more

- Provide your Social Security Number

- Have a nominated bank account or debit card for repayments. Credit Key’s application process is simple and does not affect your personal credit. Credit Key does not change any setup fees. If you choose to go beyond 30 days, you can be approved as low as 1% per month. Applying for Credit Key is a “soft inquiry.” This does not impact your FICO®/credit score.